rank real estate asset classes by risk

Derivatives fixed income real estate cash cash equivalents and equity. This chart shows asset class risk and return from 2010-2019.

One example would be Real Estate Investment Trusts REITs.

. Risks and rewards of. By Karl Steiner. Unfortunately investments that hedge against inflation tend to perform poorly when interest rates begin to rise simply because rising rates curb inflation.

In January of 2019 and 2020 I published year-in-review posts on the returns performance of various asset classes. Asset class is a group of assets with similar characteristics particularly in terms of risk return liquidity and regulations. The Ranking Table shows a Preferred section a Neutral section and an Avoid section.

You have risk associated with costs how high are regular maintenance costs how high and. Real Estate Investment Trusts. Future Of Alternatives 2025 Aum Growth Of 3 4 A Year Will Not Lift All Real Estate Segments.

Risk-weighted assets is a banking term that refers to an asset classification system that is used to determine the minimum capital that banks should keep as a reserve to reduce the risk of insolvency. Much is therefore known about the systematic returns of real estate assets held as investments1 By contrast very little seems to have been written about idiosyncratic or property-speci c real estate risk. This is notwithstanding the importance of the subject.

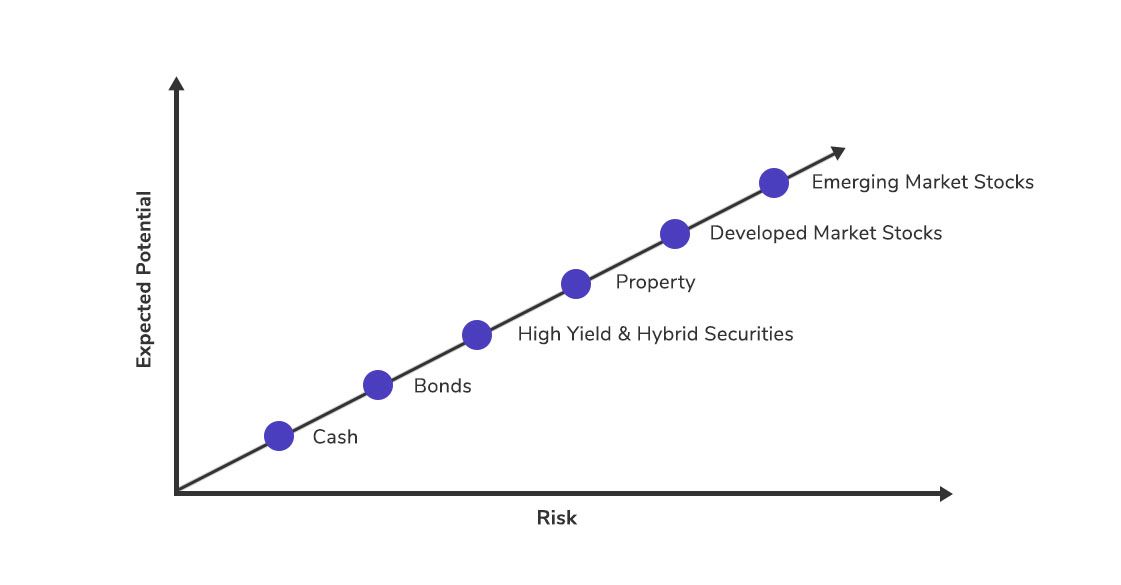

Real estate has the highest risk and the highest potential return. Needless to say economic shutdowns due to COVID-19 have had a devastating effect on commercial real estate. Asset allocation is one of the most important.

Here are the types of asset classes ranging from high risk with high return to low risk with low return. Real Estate has become an essential part of the portfolios of institutional investors and is now established as a source of diversification when combined with traditional asset classesEDHEC-Risk Institute has had a long-standing commitment to the analysis of this alternative asset class and to its value-adding integration in the field of asset allocation and multi-class portfolio. Part Ii On Asset Classes Size Of Markets And Trading Volumes By Les Nemethy And Sergey Glekov Europhoenix.

But information available can be either incorrect or difficult to understand. Tangible assets such as gold and other precious metals tend to do well when rates are low and inflation is high. This created real growth and vast improvements in productivity rather than inflation.

Banks face the risk of loan borrowers defaulting or investments flatlining and maintaining a minimum amount of capital helps to mitigate the risks. Commercial Real Estate Trends Toptal. But I have to say I.

Cash flow in real estate investment refers to the net profit the investor gets after taxes mortgage and other expenses. -Multifamily -Retail -Office -Student living -Light industrialsLogistics -Hotels -Co-working spaces I know that there are several factors playing into this but assuming as much is equal is possible what would be a plausible ranking. The major investment asset classes include savings accounts savings bonds equities debt derivatives real estate and hard assets.

However during a bear market in stocks other assets such as real estate or bonds may be showing investors above-average returns. They are arranged as per the reaction to each assets market fluctuations nature and financial goals. The position of an Asset Class within the Ranking Table is an excellent indicator of short-to-intermediate term prospects for that Asset Class.

Commercial real estate is a longer-term investment. Each has a different riskreward profile. The top-performing asset class so far in 2020 is gold with a return more than four times that of second-place US.

Negative Cash Flow Risk. Try to think about the types of risk a real estate asset has. Different states and cities can also.

The group invested 1765 of every 100 in 2019 but only 1251 this last year. The Ranking Table incorporates proven shortand intermediate-term measurements in the ranking process. What asset classes do well in rising interest rates.

Tuesday March 15 2022. Industrial has been hot across the board but the report notes that the group of 35 has been selective in this asset class. The first asset class is real estate.

Risk and return drivers for real estate include. Asset classes depict a collection of different financial instruments with identical traits and market behavior. Real estate experts and investors share different perceptions when it comes to ranking property and area classes.

Most will rank them on a general scale from Class A to Class C with others going as far as from Class A to Class F. Including lower subcategories of each class such as A- B- and C- etc. A drop in the stock market does not necessarily correlate to a fall in real estate.

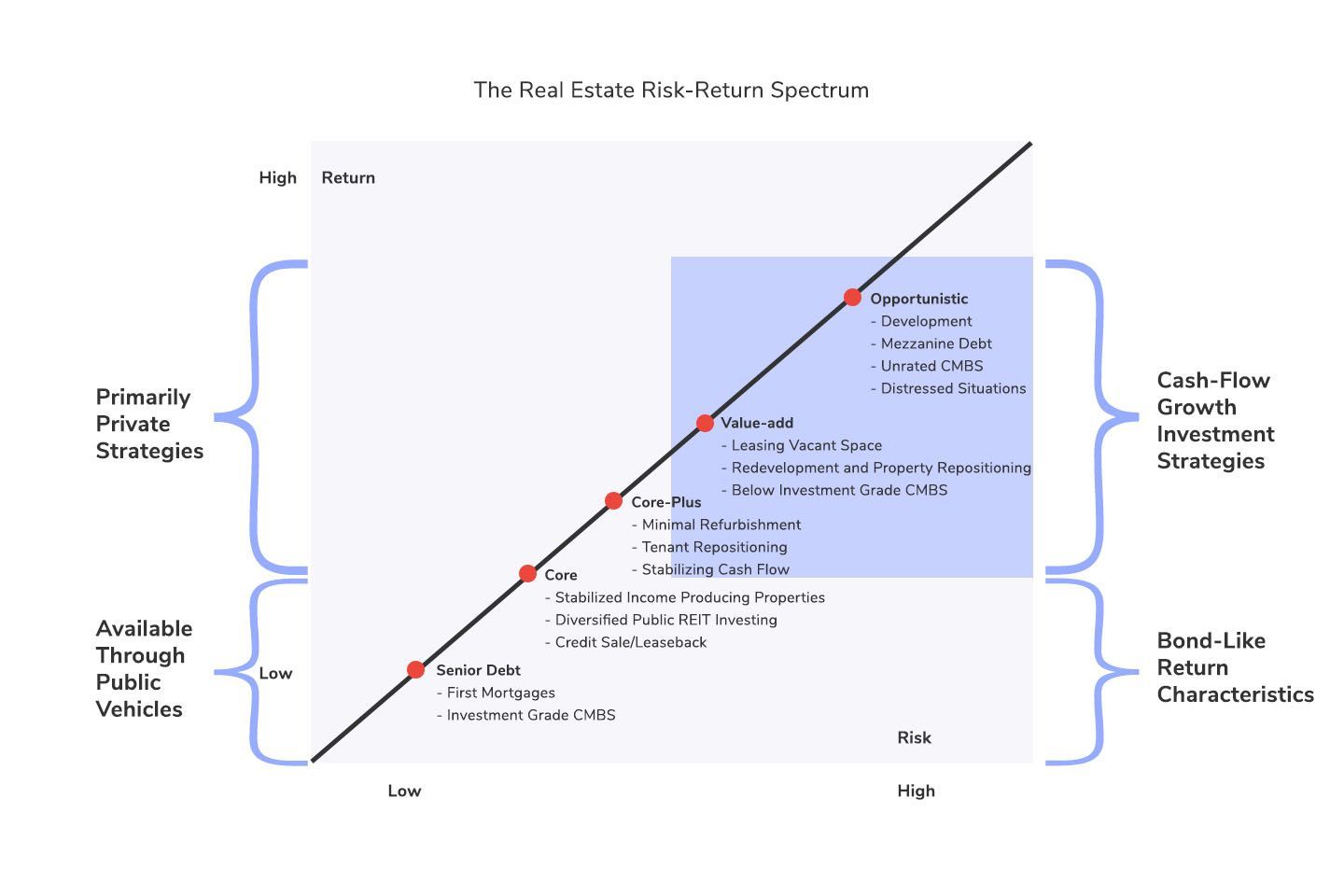

On the other hand real estate investment trusts REITs have been the worst-performing investments. Real estate as represented by the National Association of Real Estate Investment Trusts Index has been the best-performing asset class. Dear all Im having trouble to find arguments when ranking real estate asset classes in terms of risk.

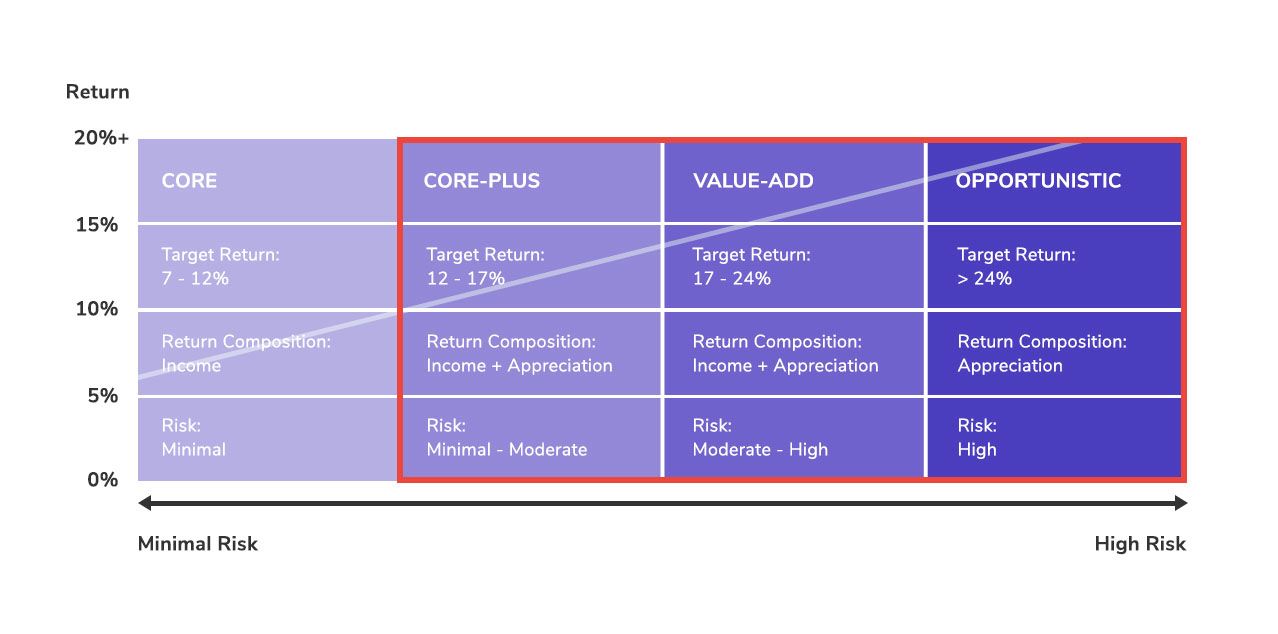

Understanding the difference between the real estate asset classes and property types is key for investors in the space. Understand why equities and real estate are the two riskiest asset classes even though they also provide the greatest potential for investment returns. Rank real estate asset classes by risk.

There are five crucial asset categories. Research on real estate primarily focuses on aggregated or portfolio-level attributes. There are significant differences between stocks and bonds different asset classes such as risk how they are traded how they pay.

Whether youre a budding real estate investor or just curious to learn more about investing heres a crash course on real estate asset classes versus property types and what you need to know. First the return correlations of commercial real estate compared to other asset classes has historically been low. You can hedge your investments in one asset class reducing your risk exposure by simultaneously holding investments in other asset classes.

Negative cash flow would occur when the taxes expenses and mortgage payments are greater than the total income thus creating a potential loss of money for the investor. You have risk associated with the durability of income which could be associated with the credit quality of the tenants the average lease term the long term demand growth for the space. Im mainly looking at.

Interesting to note though is that investment in 2020 is right in line with the 10-year historical investment allocation of 360. Commercial real estate offers two ways to diversify your investment portfolio. Equities stocks and fixed income bonds are traditional asset class examples.

Know Your Real Estate Risk Reward Spectrum Before Investing

Meyer Asset Management Ltd Tokyo Types Of Investment Funds Investing Finance Investing Asset Management

Business News Today Read Latest Business News India Business News Live Share Market Economy News The Economic Times Business News Today Latest Business News Real Estate

These Exquisite Quilts Illustrate The Importance Of Diversification In Investing Investing Asset Business Insider

2021 Real Estate Assessment Results Gresb

Best Asset Allocation Based On Age Risk Tolerance Investing Personal Financial Planning Investment Portfolio

It Support Services Monthly Contract From Just 5 00 Essex Leadership Strategies Cross Cultural Communication Business Leadership

Commercial Real Estate Trends Toptal

Know Your Real Estate Risk Reward Spectrum Before Investing

Recommended Net Worth Allocation By Age And Work Experience Investment Quotes Net Worth Best Investment Apps

Real Estate Private Equity Career Guide

Asset Class Definition Types Of Asset Classes Franklin Templeton

Management Infographic Infographic Supply Chain Management

Know Your Real Estate Risk Reward Spectrum Before Investing

Future Of Alternatives 2025 Aum Growth Of 3 4 A Year Will Not Lift All Real Estate Segments

:max_bytes(150000):strip_icc()/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)

How To Achieve Optimal Asset Allocation

Future Of Alternatives 2025 Aum Growth Of 3 4 A Year Will Not Lift All Real Estate Segments

Understanding The Real Estate Asset Class Property Types And Property Classes 2022 Bungalow